1031exchange.com

1031exchange.com

1031 Exchange Experts Equity Advantage | 800.735.1031

Start an 1031 Exchange Today. Help Save 1031 Exchanges! Contact a Team Member. We get deals done by delivering secure solutions uniquely designed to maximize the potential of each 1031 Exchange. Our goal is to help you protect equity in your investments and give you the freedom to pursue your goals. Start Your Exchange Today. HELP SAVE 1031 EXCHANGES! Learn what’s at stake and how you can make a difference. So why is working with Equity Advantage on a 1031 exchange right for you? Oil,Gas, Mineral Rights.

1031exchange.info

1031exchange.info

Homepage

1031 Exchange Mobile Cards. What is a 1031 Exchange Mobile Cards Why You Must Have IT! Get Your 1031 Exchange Mobile Cards. Once 1031 Exchange Mobile Cards is created show all contacts on your mobile phone. No carrying and storing business cards in your pockets. All access on mobile phone. Create your 1031 Exchange Mobile Cards in a matter of minutes ready for viewing on mobile phones. Unlimited Company 1031 Exchange Mobile Cards duplication for sales reps and company cards. And SO Much More. Save 50% on...

1031exchange.it

1031exchange.it

Hanley Investment Group | Hanley Investment Group Real Estate Advisors

Eric P. Wohl. CA DRE License #01348614. What is a 1031 Exchange? Ability to maintain cash position and leverage. Reduce management responsibilities through consolidation. Defer capital gains tax. Allows for 100% reinvestment of equity into replacement property. Benefits of Using HIG NNN on 1031 Exchanges:. Highly experienced 1031 Exchange team. Experience working with corporate tenants, institutional investors, multi-unit franchisees, and single tenant operators ensuring smooth transactions on all deals.

1031exchange.net

1031exchange.net

1031 Exchange, Starker, Tax Deferred

Save 25% of your profit by engaging in a real estate 1031 Tax-free Exchange. Qualified Intermediaries for Section 1031 Tax Deferred Exchanges. Friday, May 15, 2015. How much can a Section 1031 Exchange save me? Enter the original price paid for your property, plus costs and find out:. How much time do I have? Enter the date your property was sold to find out:. Start Your 1031 Online. Member of the Federation. Learn more about our featured client. 1031 Exchange Services Are Not Alike. I have property in P...

1031exchange.org

1031exchange.org

1031exchange.org

1031exchange.uslegal.com

1031exchange.uslegal.com

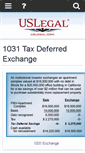

1031 Tax Deferred Exchange - Tax Section 1031 Exchange

Raquo; Tax Section 1031 Exchange Home. Raquo; 1031 Tax Deferred Exchange. 1031 Tax Deferred Exchange. A tax-deferred exchange is simply a method by which a property owner trades property for other like-kind property and has the ability to defer any capital gain or loss which would be realized upon a sale. Section 1031 of the Internal Revenue Code allows up to 100 percent deferral of the realized gain. Inside 1031 Tax Deferred Exchange. 26 U S C Section 1031. About James L. Davis. 26 U S C Section 1031.

1031exchangeadvantage.com

1031exchangeadvantage.com

1031 IRS Code Help by 1031 Exchange Advantage ™

1031 IRS Code Help by 1031 Exchange Advantage ™. Our firm has been showing investors how to buy and sell real estate. For more than thirty years. Section 1031 of the IRS code lets you sell a property and buy a new property without paying any taxes but you must use an accommodator to comply with the rules. That's where we come in. Gain Peace of Mind .Be certain the firm you choose has a. Click here to learn more. LEARN TO SELL TAX FREE. Order your Roadmap below to get started and save $200.

1031exchangeadvantage.us

1031exchangeadvantage.us

1031 Exchange Advantage

David Greenberger, Esq. I have been President of 1031 ExchangeAdvantage TM for more than 30 years. I went to law school a long time ago for two reasons: I wanted to help people, and, my mother told me to. A 1031 exchange can save you thousands of dollars in unnecessary taxes so you can reinvest all your money in a better investment and build wealth faster. LEARN TO SELL TAX FREE. Order your free Roadmap Now. Terms of Service :. Http:/ renzojohnson.com Web Developer: Renzo Johnson.

1031exchangeaustin.blogspot.com

1031exchangeaustin.blogspot.com

1031 Exchange

Monday, March 17, 2014. Spring Season Brings Tighter Seller's Market. After an unusually cold winter, which inevitably slows the real estate market down, the beginning of the Spring season is now here, with warmer weather, and a huge increase in activity. Judging from the decreasing number of days on market for new listings, and the huge buyer demand, it will once again be an active seller's market, with prices likely to rise by summer's end. How does this affect 1031 exchanges? Sunday, September 1, 2013.

1031exchangeaustin.wordpress.com

1031exchangeaustin.wordpress.com

1031exchangeaustin | 1031 Exchange Information

June 1, 2013. The Benefits of a 1031 Exchange. Please visit our site to learn about why you should consider a 1031 exchange. June 1, 2013. The Benefits of a 1031 Exchange. The Twenty Ten Theme. Create a free website or blog at WordPress.com. Create a free website or blog at WordPress.com. The Twenty Ten Theme. Follow “1031exchangeaustin”. Get every new post delivered to your Inbox. Build a website with WordPress.com. Add your thoughts here. (optional).

1031exchangeblogs.wordpress.com

1031exchangeblogs.wordpress.com

1031 Like-Kind Exchange Blog | helping you navigate through 1031 like-kind exchanges

1031 Like-Kind Exchange Blog. March 14, 2008 · 2:08 pm. In switching to a new CMS…. 8230; should the blog posts on the former site get transferred over to the new blog or should the new blog start with a clean slate? Filed under RE News. Tagged as blog posts. March 14, 2008 · 2:05 pm. Why no 1031 posting…. I’ve got 3 reasons why I have not been posting for several weeks, and not of them are individually sufficient, but combined they make sense to me. 1 Ever since 1031 Exchange Coordinators. So, while eac...